Finance solutions are created to deal with a vast array of economic requirements, from daily banking to complex investment approaches. Recognizing the various kinds of finance services can aid people and services make notified choices about handling and expanding their riches.

Retail banking is a common sort of financing service, providing essential economic devices for individuals and small businesses. Retail financial institutions use services like savings and examining accounts, which aid clients manage their funds, along with finances and charge card for financing individual and overhead. These banks additionally use online banking, mobile applications, and Atm machines to make financial management obtainable and practical. Retail banking is specifically essential for supporting local business, as it provides credit scores and cash monitoring services that permit these business to operate efficiently. By offering a reliable system for saving, investing, and borrowing, retail financial functions as the structure of individual finance for countless people.

Financial investment services satisfy individuals and organisations aiming to grow their wide range with stocks, bonds, and various other assets. Investment company offer solutions such as wealth administration, brokerage, and mutual funds, assisting clients develop profiles tailored to their economic goals and take the chance of tolerance. As an example, click here a financial expert might help a customer in choosing financial investment options for retired life savings, while a financier facilitates purchasing and marketing shares on the stock market. These solutions are essential for long-lasting economic planning, enabling individuals to get ready for future demands like retirement or education financing. Investment services additionally play an essential function in the economic situation, as they carry funds right into businesses and jobs that drive technology and job development. By supplying various investment choices, this branch of money empowers individuals and organisations to boost their financial safety and security and financial influence.

Insurance services supply critical protection against dangers, supplying financial safety and security to people and organizations alike. This sector includes health and wellness, life, building, and liability insurance, each covering different kinds of economic threats. Medical insurance helps individuals handle the expense of healthcare, while residential property insurance policy covers losses from damage to assets like homes and cars. Life insurance makes sure that dependents are monetarily sustained in case of the insurance holder's death, providing assurance and stability for households. Obligation insurance coverage, especially crucial for services, guards them from possible lawful cases that can or else intimidate their economic wellness. Insurance policy solutions make it possible for individuals to recoup from crashes and losses, guaranteeing they continue to be solvent. This sort of money solution assists alleviate the monetary effect of unforeseen events, offering both individuals and businesses with important protection and resilience.

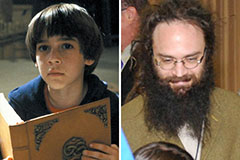

Barret Oliver Then & Now!

Barret Oliver Then & Now! Sydney Simpson Then & Now!

Sydney Simpson Then & Now! Michelle Trachtenberg Then & Now!

Michelle Trachtenberg Then & Now! Traci Lords Then & Now!

Traci Lords Then & Now! Tonya Harding Then & Now!

Tonya Harding Then & Now!